non filing of income tax return notice under which section

These mistake s make your return defective and youre issued a notice of defective return us 139 9. Mailing in a form.

Notice U S 245 Intimation Under Section 245 Tax2win

Such persons shall pay a penalty of 2 percent of the foreign income or value of the foreign assets for each year of default.

. If an assessee or an entity is unable to file income tax returns prior to the expiration of the due date as mentioned under Section 139 1 then. If you have been filing. Even if you have genuine reasons for not filing the income tax returns like your income for the financial year being under the basic exemption limits due to loss of job or less profits booked in business it is still recommended to file income tax returns.

You can find another option view my submission. Many a times it has been observed that the tax consultants file the letter with their letter head stating that the return filed by the assessee earlier may be. Here you can view information about your non-filing status.

2021 tax preparation software. As a non-resident of Canada you can choose to send the CRA a separate Canadian tax return to report your rental income from real or immovable property in Canada. If you are reporting only Canadian-source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from a business without a permanent establishment in Canada including a non-resident actor electing to file under section 2161 or if you are filing an elective return under section 217 of the Income.

Non Tax filers can request an IRS Verification of nonfiling free of charge from the IRS in one of three ways. Give a notice under section 112a shall furnish it electronically on or before the date of filing the return of income. Applicability of ITR 1 SAHAJ Return Form ITR 1 SAHAJ can be used by a ordinarily resident individual whose total income includes.

Section 273B provides that no penalty shall be imposed inter alia us271F where the assessee establishes a reasonable cause for failure referred to in said section. When you complete a section well look. If the Income Tax return is not furnished by the assessee within the timeframe underlined in the notice issued under Section 148 by the presiding Assessing Officer the assessee shall be made to pay interest under Section 2433 for late filing of Income Tax return or for not filing of Income Tax return if the income has already been determined under Section.

Section 139 of the Income Tax Act 1961 contains various provisions related to late filing of various income tax returns. Choosing to send the CRA this return is called electing under section 216 of the Income Tax Act. The assessee or the entity can still file late or belated income tax returns within a period of one year from the end of the assessment.

Section 139 9 of the Income Tax Act 1961 states that when a return is found defective the AO. If any individual or non-individual tax assessee has not filed tax returns within the specified deadline Section 139. Where any person fails to furnish a foreign assets and income statement within the due date.

Income does not exceed non-taxable limit but TDS Tax Deducted at Source is deducted and ITR is not filed. It often happens that while filing income tax returns we omit things or commit some mistakes. Prepare federal and state income taxes online.

You get a defective return notice under section 139 9 of the Income Tax Act. Efile your tax return directly to the IRS. When the notice for reassessment is received it is always desirable to file the return signed by the assessee who is authorised to sign the return us 140 of the Income-tax Act 1961.

1 Income from salarypension. State Tax Return. Once received you need to respond to it within 15 days from the date of receiving the notice.

Click on Compliance Menu Tab. 100 Free Tax Filing. Major reasons to expect notices or communication from Income Tax Department in Financial Year 2018-19 are.

Internal Revenue Code Section IRC 6212 authorizes the Service to send a notice of deficiency when a taxpayer appears to have a filing requirement but does not comply by voluntarily filing a tax return. Gives you a period of 15 days to correct the mistake. Section 1432 Notice under this section is received after a detailed enquiry has been done by the assessing officer.

If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. Such person shall pay a penalty of 01 percent of the taxable income per week or Rs 100000 whichever is higher. - Opens the menu.

Non-filing of Income Tax returns is an unlawful act and can attract serious consequences to the tax-payer. In the given facts ITAT find that there was a reasonable cause with. Section 139 4 of the Income Tax Act states the following.

Make an appointment at your local taxpayer assistance center. In case you have allready filed your income tax return please submit a copy of the acknowledgement receipt. Click on View and Submit Compliance to submit your response to the non-filing compliance notice.

2011-12 which you are required to file under the provisions of section 139 1 of the income tax act1961. This notice is about some dues which the tax payer owes to the department. If you filed a Puerto Rican or Foreign Income Tax return you must submit appropriate nonfiling documentation from a relevant tax.

TDS mismatch in ITR filed and 26AS Govt. The Pune bench of the Income Tax Appellate Tribunal ITAT has held that no penalty under section 271F of the Income Tax Act 1961 is leviable since the assessee was under an impression that the sale proceeds of agricultural activities do not attract income tax and the same is a reasonable cause to escape from the penalty proceedings. Income is more than non-taxable limits and ITR Income Tax Return is not filed.

If the assessing officer feels some income has been missed a notice is sent under this section as the income will need to be reassessed. It is noticed from the list of non filers based on annual information return in this office that you have not filed your income tax return for the ay. Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such accounts or documents as he may require or to furnish in writing and verified in the prescribed manner information in such form.

A Section 216 return is separate from any other return you have to send the CRA for the year.

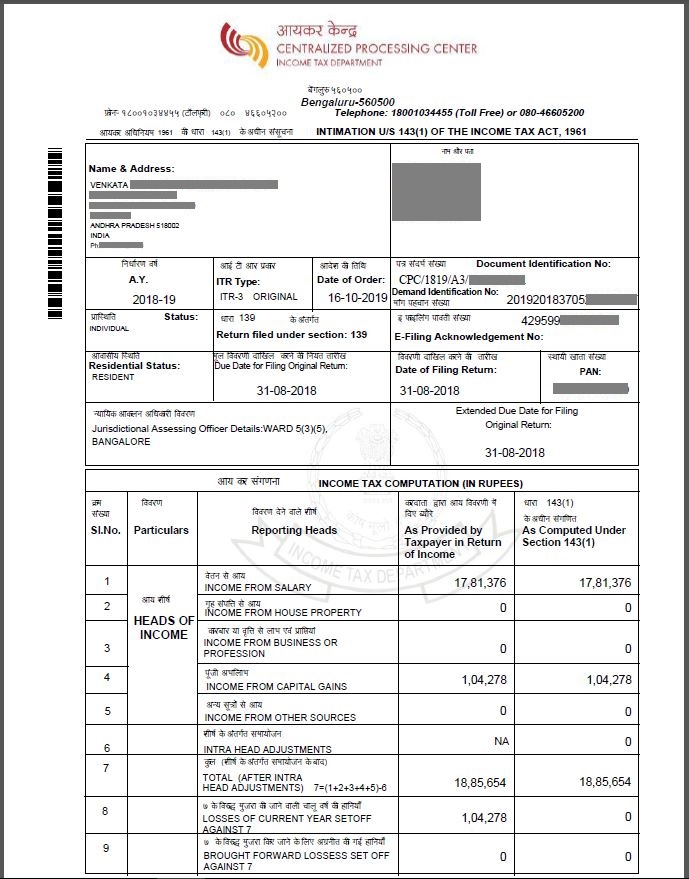

Income Tax Intimation Under Section 143 1 Learn By Quickolearn By Quicko

All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center

Section 156 Tax Notice Notice For Demand Legalraasta

All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center

Itr Processing Communication Ay 2020 21 Section 143 1 Intimation

Income Tax Notice Intimation Under Various Income Tax Acts

How To Respond To Non Filing Of Income Tax Return Notice

How Should You Respond To A Defective Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Demand Notice From Income Tax Financial Control

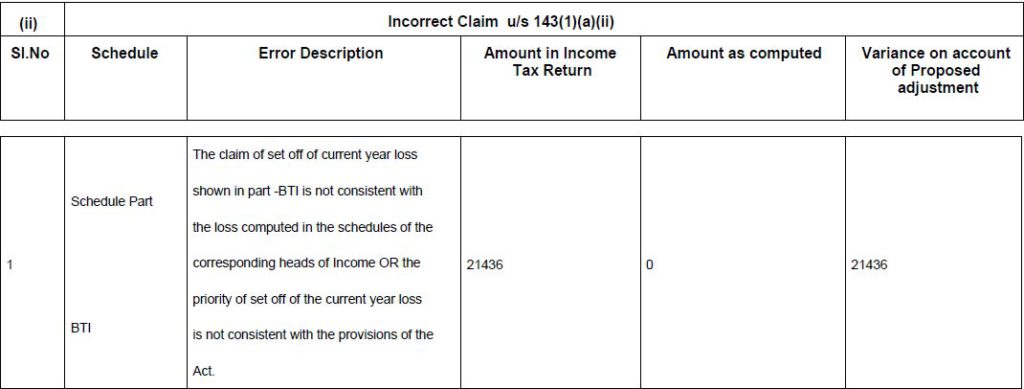

It Notice For Proposed Adjustment U S 143 1 A Learn By Quickolearn By Quicko

Income Tax Notices How To Check Income Tax Notice Online Tax2win

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Handle Income Tax It Department Notices Eztax India

Income Tax Notice Notice For Defective Income Tax Return U S 139 9 How To Respond Tax2win

All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center